Key Takeaways

-

IRS preparer head wears "acting" preparer discipline hat.

-

Treasury backs off re-evaluation of citizen volunteer committee members.

-

Eulogy for the Tax Division.

-

Will "refund boom" make OB3 popular?

-

Swiss Army Knife can't cut through tariffs.

-

Recordkeeping shortcomings help sink ranching deduction in Tax Court.

-

National Dogs in Politics Day.

Today! Tune in for a 30-minute ACA Roundtable at 1:00 p.m. Central featuring Eide Bailly ACA gurus Tonya Rule and Breanna Nagel. "Whether you’re struggling with filing obligations, new and changing regulations, or incorrect completion of forms, there are many ways companies can leave themselves at risk for large penalties." No CPE for this one. Register here.

IRS Return Preparer Office Head’s New Dual Role Raises Eyebrows - Lauren Loricchio, Tax Notes ($):

RPO Director Kimberly Rogers was designated acting director of the Office of Professional Responsibility effective July 30, according to a memorandum from Edward T. Killen, acting IRS chief tax compliance officer, that was reviewed by Tax Notes.

...

The RPO’s responsibilities include registering tax professionals to practice before the IRS, managing the enrolled practitioner program, and processing complaints against return preparers. OPR is responsible for overseeing tax practitioner conduct and disciplining tax practitioners.

With so many high-level departures at the IRS, it's not surprising to see the remaining ones where multiple hats, even when they fit poorly.

Treasury Calls Off Second "Vetting" of Tax Committee Volunteers

Treasury will no longer vet IRS federal advisory committee - Danny Nguyen, Politico:

...

That move, which prompted at least two members to resign, spurred a Treasury directive to suspend the panel’s public meetings, which meant the committee could not make any formal recommendations to the IRS.

But Treasury has since suspended the plans, an email dated Sept. 22 says.

Treasury Calls Off Vetting of IRS Committees - Benjamin Valdez, Tax Notes ($):

...

“Treasury will not be suspending meetings, has not vetted any of the members and has no plans to conduct further information collection,” a Treasury spokesperson said in a September 22 email to Tax Notes.

Two other advisory committees — the Electronic Tax Administration Advisory Committee and the Internal Revenue Service Advisory Council — will also be spared from extra vetting and will continue their usual activities, according to the spokesperson.

Both of the above stories say it's not clear what was behind the additional vetting plans.

Tax Controversy News

IRS Appeals Failed to Prevent Invalid Levies, Watchdog Says - Tyrah Burris, Tax Notes ($):

The Treasury Inspector General for Tax Administration found that for 55 levies, Appeals hearing officers didn’t input a code that prevents the levies from occurring on a taxpayers’ account, according to a TIGTA report released September 22.

...

TIGTA previously identified the 55 unlawful levy cases — which occurred when the IRS took levy action on the taxpayers after they timely requested a CDP hearing — in a 2024 audit. It said in the new report that Appeals hearing officers didn’t identify that an unlawful levy occurred and incorrectly verified that all laws and procedures had been complied with for the proposed levy action to proceed.

Related: Eide Bailly IRS Dispute Resolution and Collections Services.

A Eulogy for the Tax Division - Francesca Ugolini, Tax Notes ($):

OB3: Refund Boom? Grassley Folds. Tip Regs.

Trump’s Tax Cut Is Underwater. Can a ‘Refund Boom’ Save It? - Andrew Duehren, New York Times:

...

The second Trump administration is betting that a single, bumped-up tax refund — as opposed to marginally lower taxes saved over the course of a year — may prove to be a more effective way to market the legislation. Treasury Secretary Scott Bessent has been advertising “a refund boom” next year.

Though the "refund boom" might be somewhat offset by a compliance cost boom, given the increased complexity that the tax bill introduced.

Grassley Allows Vote on Treasury Nominees Caught Up in Tax Fight - Lillianna Byington and Ellen Gilmer, Bloomberg ($). "Sen. Chuck Grassley (R-Iowa), who announced he’d delay those picks last month, has lifted his hold as he plans to continue to work with the department on the wind and solar provisions from the tax and budget package Congress passed this year, his office confirmed Monday. Grassley and some other Senate Republicans, who have supported renewable energy, have been worried about the administration’s phaseout of wind and solar credits. Iowa is one of the nation’s largest wind power producers, according to the US Energy Information Administration."

Details on IRS prop. regs. on tip income deduction - Martha Waggoner, The Tax Adviser:

The tax break, which applies for tax years 2025 through 2028, allows for a deduction of up to $25,000 for qualified tips per return, meaning the cap applies to a taxpayer filing an individual return or to a married couple filing jointly. The deduction begins to phase out when the taxpayer’s modified adjusted gross income exceeds $150,000 ($300,000 in the case of a joint return).

Where's the TP in OB3? - Chad Martin, Eide Bailly. "Taken together, these changes, all things equal, reward transfer pricing models with relatively higher allocation of income to US corporations."

Tariff Tuesday: Kettlebells and National Security

Steel Importers Battle Their Competitors for Tariff Relief - Isabel Gottlieb, Bloomberg ($):

The tariff request “greatly overstates the potential impact of imported exercise equipment on U.S. national security concerns,” Peloton said in a plea this spring to the Commerce Department.

...

In a round of comments this summer, Commerce granted virtually all requests to tariff certain products not already falling under another tariff measure or investigation—covering 407 categories. No rebuttals arguing against them were granted.

If the Swiss Army Knife Is Made in America, Is It Still Swiss? - Liz Alderman, New York Times:

...

After decades of easy entry into America, a wall has gone up for the Swiss. If the tariffs stay in place, Victorinox will face a $13 million U.S. import tax bill next year. After keeping U.S. prices steady this year, Mr. Elsener may have to raise them. The company’s professional kitchen knives suddenly cost more than those of European competitors. And U.S. customs paperwork, once simple, is now a Kafkaesque ordeal.

“The new tariffs are hitting Switzerland’s export-oriented economy hard,” said Jan Atteslander, a director at EconomieSuisse, the lobbying group for Swiss businesses. “A swift agreement on reducing tariffs is essential.”

Taxes on Getting High Too High?

Newsom Approves Bill Reversing Calif. Cannabis Tax Hike - Sam Reisman, Law360 Tax Authority ($):

The enactment of A.B. 564 will return the Golden State's marijuana industry to a 15% excise tax rate, undoing a hike to 19% that went into effect in July. The bill takes effect immediately and preserves the 15% rate until mid-2028.

Blogs and Bits

State tax departments warn of rash of text and email scams - Kay Bell, Don't Mess With Taxes. "A fake text message purporting to be from the Minnesota Department of Revenue asks the targeted individuals to update their banking information."

The Coming Down To The Wire On Tax Extensions Edition - Kelly Phillips Erb, Forbes. "If your favorite tax person has been ignoring your calls, emails and silly memes about now, they should be forgiven–they’re likely head down working on tax returns on extension."

Using AI to Calculate Gambling Wins and Losses - Thomas Gorczynski, Tom Talks Taxes. "I used ChatGPT to determine the session gains and losses with a four-hour rule: if Carl did not place a wager for four hours, the gambling session ended, and the next one began with the next wager."

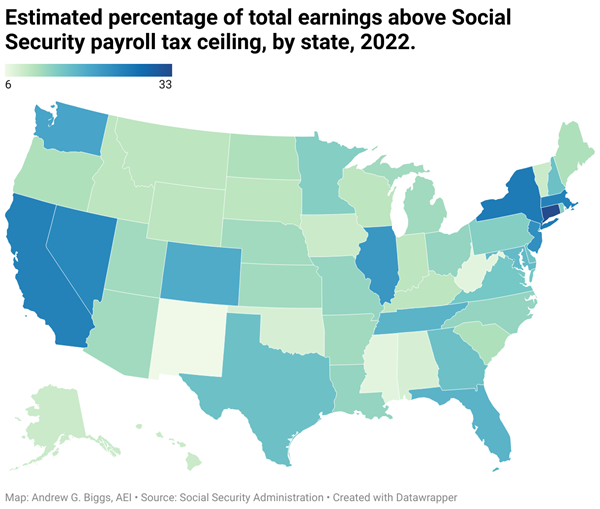

Democrats’ SALTy Social Security Solution - Andrew Biggs, Little Known Facts:

But progressives already have a favorite: eliminating the $176,100 cap on earnings subject to Social Security payroll taxes, effectively increasing the top tax rate by 12 percentage points

...

However, progressive politicians may have given less thought to who would be hit with that new tax bill. Social Security Administration data shows that, under Democratic Social Security reform plans, higher taxes would be paid primarily by high-income residents of Democratic-leaning states.

For Profit? Not, Says Tax Court

Tax Court Bucks Ranching Loss Deductions - Trevor Sikes, Tax Notes ($):

“The record is imprecise in several respects, but it leaves us with the firm impression that the Youngs did not have any profit motive for the ranching activity as of the years at issue,” Judge L. Paige Marvel wrote in a September 22 memorandum opinion in Young v. Commissioner.

The case involved one factor that often leads to IRS "hobby loss" exams: steady and large business losses offsetting high amounts of non-hobby income. It also had a factor that often leads to a taxpayer defeat: inadequate recordkeeping. From the Tax Court Opinion:

The Tax Court upheld penalties against the taxpayers, even though they had a CPA prepare their return: "The Youngs argue that they relied on Ms. Burch to prepare their tax returns for the years at issue. Mere return preparation, however, does not constitute advice."

The moral? First, don't lose money (I know, easier said than done). If you must lose money, keep good records, try to stop losing money, and document your efforts to achieve profitability. Hiring a CPA by itself isn't enough.

What day is it?

It's National Dogs In Politics Day. Sadly, it's hard for a third party to break into the duopoly.

Make a habit of sustained success.