Key Takeaways

-

To qualify for tip deduction, they must be "voluntarily given."

-

Bitcoin tips don't qualify.

-

Professions listed may still not qualify under SSTB rule.

-

Congress fails to reach shutdown deal, leaves town.

-

Feds "vetting" IRS taxpayer advisory committee.

-

Tariffs and fasteners.

-

Senior scams.

-

Happy Autumnal Equinox.

Tomorrow! Tune in for a 30-minute ACA Roundtable at 1:00 p.m. Central featuring Eide Bailly ACA gurus Tonya Rule and Breanna Nagel. "Whether you’re struggling with filing obligations, new and changing regulations, or incorrect completion of forms, there are many ways companies can leave themselves at risk for large penalties." No CPE for this one. Register here.

Who qualifies for ‘no tax on tips’ and what counts as a tip? Here are the new rules - Fatima Hussein, AP:

The tip must be voluntarily given, so mandatory tips or auto-gratuities would not qualify for the “no tax on tips” benefit. However, tip pools and similar arrangements qualify, so long as they are reported to the IRS and voluntary. The benefit is not available to married individuals who file their taxes separately.

The tip must be given in cash, check, debit card, gift card or any item exchangeable for a fixed amount of cash, unlike digital assets. And any amount received for illegal activity, prostitution services, or pornographic activity does not qualify as a tip, according to the Treasury Department.

Capitol Hill Recap: Tip of the Iceberg - Alex Parker, Eide Bailly:

Not every Internet personality will be eligible for the benefit, however. The law also blocks the deduction to those who are involved in a "specified service trade or business." That is a category borrowed from Sec. 199A, where it is used to restrict the 20% deduction available to pass-through entities like partnerships or sole proprietorships. The deduction was meant to put flow through businesses on equal footing with corporations, tax-wise, and the SSTB rules exclude service-based businesses from the benefit.

...

The legal definition of a SSTB, however, includes "services performed in the field of performing arts," meaning the "performance of services by individuals who participate in the creation of performing arts, such as actors, singers, musicians, entertainers, directors, and similar professionals performing services in their capacity as such."

Treasury’s new guidance makes it clear that it views the SSTB rules as an additional restriction which applies on top of the list of eligible professions—so some in those roles may find that they cannot deduct tips if they operate in a specified service trade or business.

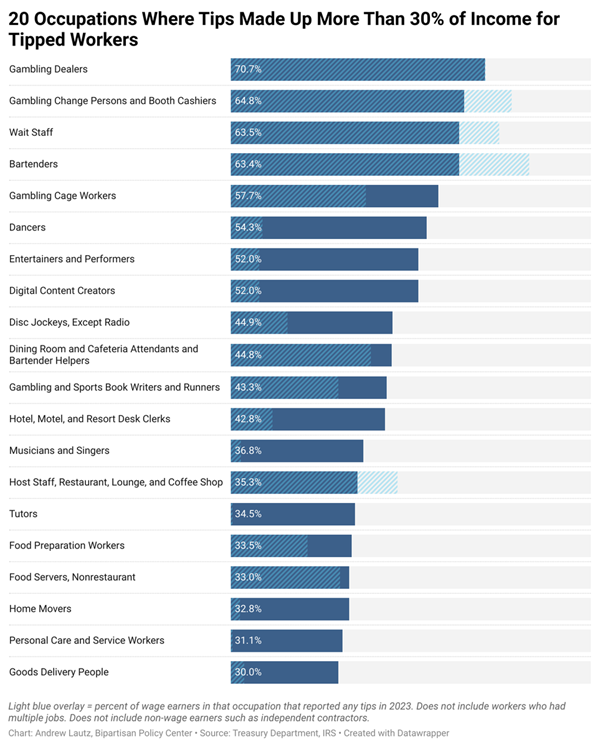

What occupations might bump up against the law's $25,000 tips deduction limit? - Andrew Lautz on X/Twitter. "New IRS data suggests: card dealers, waiters, bartenders, and digital content creators. The below chart shows 20 occupations where tips made up 30%+ of income among workers who reported tips."

Proposed Regs Map Out Qualified Tips and Jobs for Tax Deductions - Trevor Sikes and Alexander Rifaat, Tax Notes ($):

However the proposed regs acknowledge that more steps may be needed to stop abuse. “Treasury and the IRS are concerned that taxpayers might misclassify income as tips and request comments on how to address this issue in the final regulations,” they said.

Congress Takes Week Off Ahead of Shutdown Deadline

Why a government shutdown looms as Congress splits town - Cameron Joseph, Christian Science Monitor.

A short time later, the Senate voted on that measure and an alternate bill offered by Democrats that had a number of their health care policy priorities. Both failed to pass.

That leaves the Senate with just two workdays to avoid a shutdown when it returns.

Shutdown Fears Grow as Senate Rejects Two Stopgap Options - Cady Stanton, Tax Notes ($):

The proposals considered in the House and the Senate September 19 would extend government funding at fiscal 2024 levels until at least the end of October, but neither was able to gain the bipartisan support necessary to pass in the Senate. Senators are now scheduled to recess until September 29 ahead of a September 30 government funding deadline, while the House isn’t set to return until October 1.

A Republican-led continuing resolution advanced through the House in a 217-212 vote in the morning but hit a wall in the Senate, where bipartisan support is required to overcome the filibuster. The measure failed to meet the required 60-vote threshold in a 44-48 vote.

IRS and Tax Administration

How the Trump Administration Could Target Nonprofits, Explained - Erin Schilling, Bloomberg ($):

But under Section 501(p) of the Internal Revenue Code, it’s easier to revoke the tax-exempt status of terrorist organizations. A terrorist organization can be designated by an executive order if a group is deemed to be “supporting or engaging in terrorist activity” or “supported terrorism,” as defined by the Immigration and Nationality and Foreign Relations Authorization acts.

...

Organizations can’t challenge the suspension under 501(p). There are nine organizations that have had their status suspended under this code section, according to the IRS. Losing tax-exempt status means donations are no longer tax deductible.

Related: Eide Bailly Exempt Organization Tax Services.

White House vetting IRS federal advisory committee - Danny Nguyen, Politico:

But that recommendation, which came as the IRS announced it would share data with federal immigration enforcement to conduct deportations, died in a higher committee in the spring.

“We watered it down to make it feel benign enough to not be political in nature,” the panel member said.

Apparently recommending compliance with "regulatory and legal requirements when disclosing taxpayer information" is politically fraught now.

IRS Contract Documentation Woes Continue - Tyrah Burris, Tax Notes ($). "In a report released September 19, the Treasury Inspector General for Tax Administration sampled 28 non-IT Inflation Reduction Act contracts totaling $309 million and found that the preaward and postaward documentation of contracting officers and their representatives was incomplete for each contract. None of the contracts met quality standards, nor did they comply with Federal Acquisition Regulation requirements, TIGTA said."

Turning the Tariff Screw

Trump’s Tariffs Are Damaging America’s Biggest Foreign Source of Screws - Meaghan Tobin and Xinyun Wu, New York Times:

The island is also a major source of another essential and often invisible component of everyday objects: screws. And most go to the United States, where they are used to build airports, backyard decks and bathroom cabinets.

Now, President Trump’s 50 percent tariffs on steel and aluminum, which took effect in June, have left Taiwanese screw makers wondering how their businesses will survive the next few months. For the United States, Taiwan has been the No. 1 source of screws and metal fasteners like nuts and bolts for more than three decades, with China gaining ground as the second largest.

Preserving Refunds As Tariffs Await Supreme Court Weigh-In - Catherine Karol, Jennifer Smith-Veluz and Mitchell Zajac, Law360 Tax Authority ($):

Second, and perhaps more likely, companies may have to submit post-summary corrections of unliquidated entries or protests of liquidated entries to claim refunds.

...

Either way, importers should carefully keep records of imports on which they have had to pay IEEPA tariffs and carefully monitor the liquidation dates, so that they will be able to make the proper submissions.

Foreign Account Taxpayer Victory, For Now

U.S. Court Tosses FBAR Suit for Seventh Amendment Violation - Amanda Athanasiou, Tax Notes ($):

...

The government filed its complaint in the action in November 2024 alleging that Sagoo held interests in accounts in England, India, and Kenya between 1996 and 2014 and that she concealed foreign accounts and related interest income from U.S. authorities and her accountant.

In December 2022 Sagoo was assessed a penalty of over $1 million for the 2011-2013 tax years, which Sagoo has failed to pay, the government said, adding that a recalculation of penalties may be required after the court determines Sagoo’s liability for willful penalties.

Expect the government to appeal, and perhaps win. Be careful with those foreign accounts in the meantime.

Blogs and Bits

IRS formally announces occupations eligible for no-tax-on-tips deduction - Kay Bell, Don't Mess With Taxes. "In addition to being ineligible for the no tax on tips provision, tax law also already restricts or prevents SSTBs from claiming the qualified business income (QBI) deduction and the state and local taxes (SALT) deduction."

When Asked For Your Social Security Number, Should You Provide It? - Robert Wood, Forbes ($). "If you want to be paid, refusing to hand over a W-9 may not make sense. The IRS says that anytime a payor thinks they may have to report a payment on an IRS Form 1099, they should ask for a Form W-9. If they fail to get one signed, they may have to withhold taxes on the payment, even if you are not an employee."

What Farm Tax Clients Need to Know About S Corporations and Self-Employment - Ashley Akin, Tax School Blog. "One common misconception is that S corporations eliminate self-employment tax."

IRS Ramps Up Puerto Rico Tax Shelter Crackdown With Subpoena of Baker McKenzie - Ronald Marini, The Tax Times. "The spotlight is on advice rendered by former Baker McKenzie partners who have a history of publishing and presenting on the tax advantages for Americans relocating to Puerto Rico."

Related: Eide Bailly Dispute Resolution and Collections Services.

Quotable

"Enquiring minds wish to know whether the $50,000 bag of cash was reported on Mr. Homan’s tax return." - Scott Sumner, The Pursuit of Happiness.

Senior Scams

Save our Seniors efforts results in eight arrests - IRS (Defendant names omitted, emphasis added):

The scammers wear many hats. Don't believe anybody from "the government" who says you are in trouble by email, text or phone. Don't trust strangers bearing tech support.

Fighting scams is an IRS enforcement function. Hobbling IRS enforcement at some point means more grandmas get fleeced.

What day is it?

It's the Fall Equinox, where days and nights are the same length. For tax pros facing extension deadlines, the days seem both longer and shorter at the same time.

Make a habit of sustained success.