Key Takeaways

-

Tax Court: legal weed businesses can't use disallowed W-2 for QBI "pass-through" deduction.

-

A side effect of Sec. 280E prohibition of most deductions for Schedule 1 drug sellers.

-

Korb touts 50+ years of experience for top IRS lawyer role.

-

Payroll firms facing ERC lawsuits.

-

Estimated tax deadline coming up.

-

Business purchase due diligence: why tax compliance remains important.

-

National Chocolate Milkshake Day, National Video Game Day.

One week from today! Taxpayers still are foot-faulting their way into enormous reporting penalties under the ACA. Learn the rules and how problems can be fixed during the Eide Bailly Webinar Affordable Care Act Compliance in Depth. Friday, September 19, 1:00 p.m. Central. No charge, 1 hour CPE available. Register here.

Passthrough Deduction Subject to Drug Business Expensing Limits - Kristen Parillo, Tax Notes ($):

“Nondeductible wages cannot be included in ‘qualified business income’ for purposes of section 199A(c)(1) because the statute expressly excludes them from the scope of that concept,” Tax Court Judge Emin Toro wrote in a September 11 reviewed opinion in a consolidated case, Savage v. Commissioner.

Toro’s opinion was joined by 16 other Tax Court judges, with Judge Rose E. Jenkins dissenting.

Full Tax Court Limits Deduction For Cannabis Biz Owners - Anna Scott Farrell, Law360 Tax Authority ($):

In analyzing the text of Section 199A, Judge Emin Toro said for the majority that wages are considered qualified business income for the pass-through deduction "only 'to the extent' they are 'allowed in determining taxable income for the taxable year.'" If wages are not allowed in the calculation for determining taxable income, then they are not considered qualified, the court said. Judge Toro called those wages "nondeductible."

The issues in this case arise from the interaction of Reagan-era and Trump I tax provisions.

Sec. 280E, enacted in 1982, disallows deductions other than direct inventory costs for sales of Schedule I drugs, which includes cannabis. That means state-legal cannabis businesses cannot deduct other ordinary business expenses, such as W-2 wages.

Sec. 199A, enacted in 2017, allows individuals to claim a deduction of 20% of "qualified business income" on their returns. This is often income from partnerships and S corporations, leading to the term "pass-through deduction," even though sole proprietorship income can also qualify.

If taxable income exceeds certain phased-in thresholds, the deduction is limited to 50% of a taxpayer's share of W-2 wages paid by the business. The 2025 phase-out ranges are $394,600 - $494,600 for joint filers and $197,300 - $247,300 for other filers. The decision says cannabis business non-deductible W-2 wages don't count for this purpose.

IRS Leadership New Blood

Trump's Pick For Top IRS Atty Touts Experience At Agency - Asha Glover, Law360 Tax Authority ($):

"Having been there many times now, I understand that late guidance is not helpful at all," Korb said.

Korb said he has almost 52 years of experience in federal taxation in both the public and private sectors. He was an attorney-adviser in the chief counsel's office from 1974 to 1978 and a special assistant to then-Commissioner Roscoe Egger in the mid-1980s, when he coordinated agency work on the 1986 tax overhaul law, according to the IRS. He served as chief counsel from 2004 to 2009.

Tax Writers Seek Stable IRS Leadership - Zach Cohen, Bloomberg ($):

...

Treasury Secretary Scott Bessent has been leading the agency on an acting basis since Long’s departure. Lawmakers aren’t eager to keep him in that role in the long-term as Bessent juggles negotiation of new trade deals amid a rash of tariff threats.

“He’s got a plate full,” said Sen. Roger Marshall (R-Kan.), another tax writer. “I just can’t imagine there’s enough hours in the day.”

The article says that the position, which has been filled by seven different people already this year, may not be the most attractive government post right now. It does have Spinal Tap drummer vibes about it.

ERC Agonistes

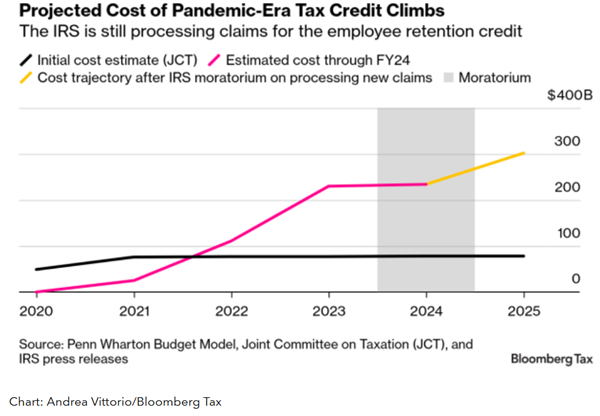

Lawsuits Mount Against Payroll Firms Over Pandemic Tax Credits - Erin Schilling, Bloomberg ($):

...

Tax professionals said they’re seeing more audits into payroll companies and a wave of letters to businesses that the IRS suspects filed inaccurate claims. The IRS has sent 84,000 letters as of April either partially or fully disallowing ERC claims, according to the National Taxpayer Advocate.

Small businesses often use third-party professional employer organizations to outsource payroll and human resources, which filed the ERC claims on behalf of their clients. Because payroll companies are also liable for inaccurate claims, some are now reevaluating whether their clients qualify for the credit and are sometimes withholding refunds issued by the IRS, said Justin Elanjian, a Frost Law managing director who specializes in ERC claims.

Related: Big IRS ERC Claim Exam Push Underway.

OBBBA Update: Research and Interest Deductions

New Research Deduction Guidance Arrived at Right Time, Pros Say - Nathan Richman, Tax Notes ($):

Rev. Proc. 2025-28 provided the IRS’s answers about how to apply those transition rules, including an option to amend prior returns for small business taxpayers and an accelerated recovery for all taxpayers with outstanding amortization balances.

Related: Congress Approves Expensing Fix for R&D Costs Under New Tax Bill.

Key Real Estate Considerations under the One Big Beautiful Bill - Donny Matteson and Thomas Ahrens, Eide Bailly. "The OBBB also creates a new category of property, called Qualified Production Property, eligible for full expensing. This provision generally incentivizes domestic manufacturing and factory production and will benefit businesses building or converting existing properties to production facilities."

OBBBA Has Mixed Effects on Interest Deduction - Carrie Brandon Elliot, Tax Notes ($):

Tariff Friday

Customs duties hit new record in August on tariff revenues - Tobias Burns, The Hill. "Customs duties — which are mostly tariff revenues — hit $30 billion in August, which is up almost 300 percent since last year, the Treasury Department reported Thursday."

Health insurance premiums poised to spike over drug costs, tariff threats - Peter Whoriskey and Paige Winfield Cunningham, Washington Post:

...

In explaining the rising prices, insurers and employers point to two recent factors: the tariffs on pharmaceutical imports being considered by the Trump administration and the high cost of new obesity treatments, called GLP-1 drugs.

Yes, Your Morning Coffee Has Gotten More Expensive - Sydney Ember, New York Times:

...

Many coffee companies initially tried to absorb the higher costs of the levies, including the blanket 10 percent tariff that was imposed on U.S. trading partners in April.

But with the sky-high tariffs on some coffee-producing countries now in effect, roasteries and coffee shops across the country appear to have run out of room to keep prices low for customers. Mr. Trump, for instance, has imposed tariffs of 50 percent on imports from Brazil, 20 percent on Vietnam and 19 percent on Indonesia.

Blogs and Bits

Pay your third estimated tax amount by Monday, Sept. 15 - Kay Bell, Don't Mess With Taxes. "The September estimated tax amount is the third of the tax year. It pays tax on income earned in June, July, and August that wasn’t subject to withholding."

Be smart like Kay and pay electronically. If you must pay by check, read Kay's post for the correct new mailing addresses.

Inequities of tip income deduction + tip for contractors providing services to non-business customers - Annette Nellen, 21st Century Taxation. "Hopefully the roughly 90% of workers who don't get this tax break even though they have earned income equal to or less than tipped workers, will demand its repeal with any income tax break tied to providing a break to low to middle income workers based on income rather than occupation and who they work for."

Will There Be Tax Free Tips For The Piano Man? - Peter Reilly, Forbes:

Washington Says Tax Breaks Help People. Instead, They're Corroding the Tax Code. - Veronique de Rugy, Reason via Cafe Hayek: "Also failing are education credits, such as the American Opportunity Tax Credit. Decades of research show no measurable impact on college enrollment or completion rates. Colleges surely pocket some of the subsidies through higher tuition, but students are not attending in greater numbers. Here again, tax revenue vanishes with almost nothing to show for it."

Buying Trouble

Coney Island Sunoco Buyer Held Liable for State Sales Tax Bill - Perry Cooper, Bloomberg ($):

Nacmias & Sons Auto Service LLC bought the gas station, along with the Sunoco lease and franchise agreement, in a 2008 bulk sale. But it failed to notify the state tax department of the sale in time to avoid taking on the former owner’s sales tax liabilities for 2006-2009, the New York Tax Appeals Tribunal ruled.

When a business purchase is structured as a sale of assets, rather than of the business entity, buyers often believe that they don't have to worry about the seller's hidden tax problems. This case reminds us that even asset purchasers need to be aware of seller tax risks.

It also reminds us that tax compliance matters even in an era of reduced federal tax enforcement. A business seller might be confident that the IRS or state revenue departments will be caught napping, but the buyer isn't going to want to bet money on it. Tax noncompliance will at best complicate a deal, will likely reduce the purchase price, and might even wreck it altogether.

Related: The Essential Guide to Due Diligence

What day is it?

It's National Chocolate Milkshake Day! It's also National Video Game Day, which can easily be celebrated with a tasty shake.

Make a habit of sustained success.