Key Takeaways

- Larger refunds expected in the coming tax season.

- IRS failure to adjust withholding tables defers tax cut benefits.

- GOP moderates force January vote for enhanced ACA tax credit extension.

- IRS financial crimes enforcement emphasis.

- International tax competitiveness winners and losers.

- Tax Obscura: the zombie individual mandate.

- Bake Cookie Day.

Stressed IRS Faces Record Refunds This Tax Season - Doug Sword, Tax Notes ($):

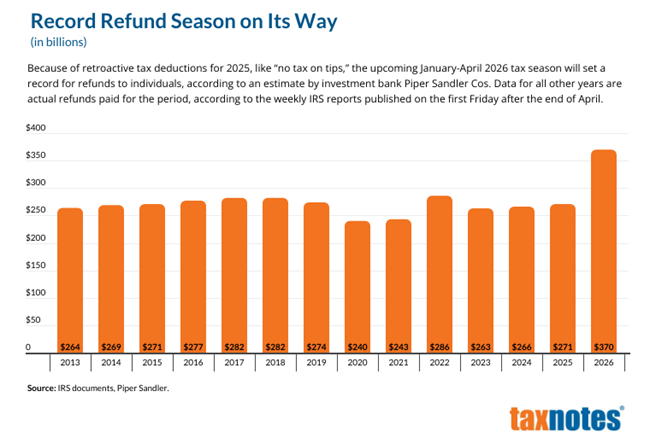

A litany of tax breaks that retroactively went into effect at the beginning of 2025 — a quadrupling of the state and local tax deduction cap, enhancements to the standard deduction, breaks regarding tip and overtime income, and deductions of auto loan interest, to name a few — will translate into an added $91 billion in refunds during the January-to-April 2026 filing season, according to investment banker Piper Sandler Cos.

That would boost refunds for the three-month period to $370 billion assuming all of it goes toward refunds rather than being used to reduce tax liabilities. That would be 37 percent higher than the $271 billion in refunds sent during the 2025 tax season and 29 percent higher than the previous high of $286 billion in 2022.

While the tax law was signed in July, the administration made no adjustments to withholding rules. That means the government borrowed taxpayer money without paying interest to give it back during an election year.

Tax Refunds and the One Big Beautiful Bill Act - Erica York, Tax Policy Blog:

Fun House

Republican Defections Force Future House Vote on ACA Tax Credit - Katie Lobosco, Tax Notes ($):

...

Either way, the enhanced premium tax credit will expire after December 31 because there’s no time for the Senate to act before leaving for the holiday recess. While open enrollment for the ACA marketplace remains open until January 15, people had to enroll by December 15 to avoid a lapse in coverage in January.

If the vote to extend the ACA tax credit is successful in the House, it’s unclear if it could pass the Senate, where an identical three-year extension was voted down on a 51-48 vote December 11.

A Surprise In The House Could Decide The Fate Of Affordable Care Act Subsidies - Kelly Phillips Erb, Forbes:

Four Republicans (Brian Fitzpatrick, Rob Bresnahan, and Ryan Mackenzie of Pennsylvania, along with Rep. Mike Lawler of New York) signed on to a Democratic-led discharge petition introduced by House Minority Leader Hakeen Jeffries (D-N.Y.) last month.

A discharge petition, which is a procedural move, compels a floor vote when House leadership won’t call a vote. It is rarely used in the House because it's extremely difficult to get the necessary 218 signatures.

Johnson, Jeffries, GOP mods and a crazy week - Jake Sherman, John Bresnahan, Punchbowl News:

This proposed GOP legislation includes limited reforms of pharmacy benefit managers, cost-sharing reduction and association health plans. The Congressional Budget Office says that the legislation would result in 100,000 people losing their health care, but premiums would fall 11%.

However, these are all policies that the House has passed before — and they’ve been rejected by the Senate. If Senate Majority Leader John Thune brings this bill up, Democrats will almost certainly block it.

So in less than two weeks, millions of Americans will see a huge spike in their premiums or they’ll lose coverage as Congress goes over the Obamacare cliff.

Digital Reporting Headaches, IRS Enforcement Priorities

Even an expert says: Digital asset reporting creates headaches - Martha Waggoner, The Tax Adviser:

His best advice: “Encourage your clients to keep the records and, in the absence of that, push them to sign up for a third-party software that you have vetted that has SOC (System and Organization Controls) reports and that you believe to make your life easier, because these 1099-DAs are probably going to make your life more difficult,” he said during the session, “Prepare to Help Clients With 2025 Forms 1099-DA.”

$10.6B in financial crime flagged as IRS sharpens enforcement - Tax Coda:

...

The report sends a clear signal about enforcement priorities.

IRS is framing tax enforcement as part of a broader financial crime ecosystem rather than a standalone function. Crypto, bank compliance failures, sanctions evasion, and traditional tax fraud are now presented as overlapping risks rather than separate lanes.

Crossing Borders: OECD Deal Struggles, The Estonian Call, International Competitiveness

Tax News & Views International Weekly: Global Minimum Tax Agreement in Jeopardy - Alex Parker, Eide Bailly:

If the impasse stretches into 2026, it could be a whole new ballgame.

Estonia, Czechia Drop Opposition to Revised Minimum Tax Deal - Saim Saeed, Bloomberg ($):

Their assent means all EU countries have signed on to the new agreement after the two and Poland had voted last week against its adoption at the Organization for Economic Cooperation and Development.

Movers and Shakers in the International Tax Competitiveness Index - Alex Mengden, Tax Policy Blog:

1. United States, which ranked 29th in 2014 and now ranks 14th

2. Canada, which ranked 25th in 2014 and currently ranks 13th

3. Greece, which ranked 30th in 2014 and is now at 23rd

4. Hungary, which placed 14th in the 2014 rankings and has climbed to 9th

5. Iceland, which ranked 34th in 2014 and has risen to 29th

The five countries that fell the furthest in the rankings between 2014 and 2025 are:

1. Colombia, which ranked 24th in 2014 and currently ranks 36th

2. Poland, which ranked 23rd in 2014 and is now at 35th

3. Belgium, which placed 20th in 2014 and has now fallen to 30th

4. Chile, which ranked 22nd in 2014 and is now at 28th

5. The Czech Republic, which was 5th in 2014 and has dropped to 10th The Meta Transfer Pricing Exam

IRS Takes a New Shot at Meta’s Foreign Tax Strategy - Richard Rubin, Wall Street Journal:

But critics of that moment-in-time approach argue that there is a fundamental problem. Companies know more than the government does about their businesses and can arrange internal deals to reap outsize low-taxed profits abroad.

Advocates for the new IRS approach cite a tax code section that says the government can look at internal transactions and adjust companies’ taxes to reflect their true income. In 1986, Congress specified that profits made after transfers or licenses of intangible assets can be allocated so they are “commensurate with income.” Tax lawyers have spent the subsequent four decades debating what that means.

Related: Eide Bailly Transfer Pricing Services.

Blogs and Bits

Mixed market results? Tax loss harvesting can help offset Uncle Sam’s take on asset gains - Kay Bell, Don't Mess With Taxes. "If you’re tempted to buy a replacement stock for the losing one you sold, be careful. You could trigger the tax code’s wash-sale rule, which would invalidate your tax loss harvesting benefit."

IRS Interprets One Big Beautiful Bill to Increase W-2G Threshold to $2,000 - Russ Fox, Taxable Talk. "I do need to point out whether or not you receive a W-2G does not change whether your gambling winnings are taxable (they are)."

Illinois should raise taxes on the most harmful types of sports betting - Michael Miller, A City That Works. "To get specific: the per-wager Illinois sports betting fee should be increased for in-game betting and certain parlays to better target and disincentivize the most negative forms of sports wagering."

State Corporate Rates Still Matter Under Single Sales Factor Apportionment - Jared Walczak, The SALT Road. "Even in today’s global economy, many C corporations are regional, and they experience the full brunt of a state’s high corporate income tax."

True. Also, most states now have single-factor apportionment, so single-factor is no longer the unique competitive advantage that it was when Iowa was the only-single factor state. Iowa has been slow to get the message, though, as it still has an uncompetitively-high 7 percent corporate tax rate.

Related: Eide Bailly State and Local Tax Services.

Tax Obscura: Replacing the ACA Stick with an Enhanced Tax Credit Carrot.

Congress is in the midst of a battle over enhanced tax credits for Affordable Care Act insurance. One aspect of the debate is that expiration of the enhanced tax credits will increase individual premiums. This is because the enhanced credits have kept healthier people in the insurance pool, allowing lower per-person premiums overall. The loss of the enhanced credits is expected to cause some healthier high-income taxpayers to drop coverage.

Carrots vs. Sticks. The expiration of the enhanced tax credit removes a carrot incentivizing taxpayers to obtain ACA insurance. When the ACA was first enacted, Congress used a stick instead: The Sec. 5000A "Requirement to maintain minimal essential coverage," also known as the "individual mandate." By imposing a tax on the uninsured, the ACA attempted to nudge healthy taxpayers into buying insurance to broaden and improve the risk pool.

For each month a taxpayer went without required coverage, the tax was 1/12 of the greater of:

- a flat dollar amount ($95 in 2014, $325 in 2015, $695 in 2016; half for under‑18; indexed after 2016); or

- a percentage of income (1% in 2014, 2% in 2015, 2.5% in 2016–2018).

The tax was capped at the sum of monthly national average bronze plan premiums for the “shared responsibility family.”

This tax was key to the Supreme Court ruling that held the ACA to be constitutional, but it was never popular. It was enacted in 2010 in the ACA, but with its effective date delayed to 2014. Even then, Congress restricted enforcement, forbidding the use of liens and levies for collection.

In 2019, the IRS set the rate at zero - leaving the tax on the books, but meaningless.

In theory, Congress could try to address ACA affordability by restoring Sec. 5000A. That doesn't seem to have come up in the debate over the enhanced tax credits.

What day is it?

It's Bake Cookies Day - a holiday we can all get behind.

Make a habit of sustained success.