Key Takeaways

- Trump withdraws top IRS lawyer pick.

- Congress eyeing health care fixes.

- IRS after shutdown.

- Tariff checks said to require legislation.

- Certain tariffs repealed Friday.

- OBBBA and tips & overtime.

- Transportation tax policy.

- National Homemade Bread Day!

IRS Pick Withdrawn

Trump Withdraws His Pick for Top IRS Lawyer - Richard Rubin, Wall Street Journal:

Korb was nominated to be the chief counsel, one of two-Senate confirmed posts at the IRS. The chief counsel oversees the IRS’s lawyers, who litigate cases in U.S. Tax Court, write regulations and advise IRS employees on how to apply the tax code.

Life Post Shutdown

After The Shutdown, Lawmakers Eye Health Care Fixes - Renu Zaretsky, Tax Policy Center:

IRS Aims to Send Most Back Pay by November 19 - Benjamin Valdez, Tax Notes ($):

In an email sent to all employees on November 14, the IRS said it anticipates that the majority of back pay will be paid on November 19. Employees can expect to receive the rest of their pay by November 24, according to a FAQ on the agency’s internal site viewed by Tax Notes.

More on Tariffs

Bessent: $2K tariff checks will require legislation in Congress - Sarah Fortinsky, The Hill:

...

The renewed focus on affordability comes after Democrats’ sweeping victories in this month’s elections, with many successful candidates running disciplined campaigns focused on affordability.

Trump cuts tariffs on scores of products in bid to lower prices - Julia Manchester, The Hill:

The products that are no longer subject to tariffs, include coffee, tea, beef, bananas, tropical fruit, wood and iron.

Trump repeals tariffs on some foods as Americans face high grocery prices - Alec Dent and David Lynch, Washington Post:

A majority of Americans say they are spending more on groceries than they were last year and they blame Trump for the increased costs, according to a Washington Post-Ipsos poll conducted in late October.

Critics of Trump’s tariffs celebrated the move and called on the president to end his other tariffs as well.

What’s Next for Tariffs After the Supreme Court Hearing? - Mindy Herzfeld, Tax Notes ($):

The Court’s decision on IEEPA could prompt Congress to act in a manner that would restrict the president’s ability to prompt retaliation as a result of his imposition of arbitrary tariff duties, and in so doing, protect U.S. trade in services from facing reciprocal tariffs in other countries.

OBBBA - Tips and Overtime

Tips and Overtime Concerns Remain Despite Penalty Relief - Trevor Sikes, Tax Notes ($):

...

Notice 2025-62 only gives reprieve for penalties under sections 6721 or 6722 to employers for returns filed in 2025.

“Businesses need to be mindful that 2026 is quickly approaching, and they need to be mindful of their obligation to report, considering the system adjustments that need to be made,” Mahoney said.

Tax Policy - Transportation

How to Refuel the Highway Trust Fund - Alex Muresianu and Jacob Macumber-Rosin, Tax Foundation:

...

A VMT tax is the most efficient and sustainable option for US highway funding amid rapidly changing markets and technologies. It best achieves the user-pays principle, aligning taxes paid with actual road use, vehicle weight, and infrastructure costs.

That said, a full VMT system would be complex to establish and administer. A hybrid approach, replacing truck-related excise taxes with a VMT tax on freight, retaining the gas tax, and adding flat registration fees on passenger traffic, delivers most of the same benefits with fewer administrative challenges.

There’s a New Effort on the Runway to Raise Climate Fund - Somini Sengupta, New York Times:

The would-be premium passenger tax aims to change that.

Blogs & Bits

IRS Issues Applicable Federal Rates (AFR) for December 2025 - Bailey Finney, Eide Bailly:

Annual Adjustments to Retirement Plan Limitations: Analysis of Notice 2025-67 for 2026 - Ed Zollars, Current Federal Tax Developments:

Analyzing the OBBBA

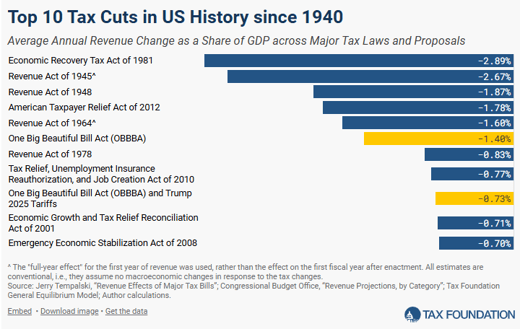

Is the OBBBA the “Largest Tax Cut in American History?” - Erica York and Emily Kraschel, Tax Foundation:

Though it is a significant tax law, the reduction in tax revenue from the OBBBA ranks not as the largest, but as the the sixth largest tax cut in US history. Factoring in the president’s tariff tax increase further drops its ranking to the eighth largest tax cut in US history.

In the Courts

Madoff Victims Lose Bid To Claim $8.2M Theft Loss Deduction - Kat Lucero, Law 360 Tax Authority ($) (Taxpayer names omitted):

...

The investments became worthless after authorities discovered that Madoff was running a fraudulent investment scheme in 2008, devaluing Taxpayer's policies by $8.23 million. The couple claimed that amount as a theft loss deduction in their tax return, but the Internal Revenue Service denied it. The Tax Court sided with the IRS after the couple challenged that determination.

What day is it?

Make a habit of sustained success.