Key Takeaways

- Trump signs bill ending shutdown.

- ACA credit extension behind shutdown not included.

- IRS faces shutdown backlog.

- Tariffs - cranes, coffee, arithmetic.

- Acting IRS Commissioner v. IRS on partnership SE taxes.

- National Hug a Musician Day.

Payroll Compliance Alert! The Eide Bailly Payroll Team is presenting a free CPE-eligible webinar this afternoon: Close the Year with Confidence: Payroll, Compliance, & Reporting Essentials.. 2:00 p.m. Central, today. Register here.

Shutdown Ends

Trump Signs Spending Bill, Ending Longest Shutdown in U.S. History - Katy Stech Ferek, Olivia Beavers and Richard Rubin, Wall Street Journal:

...

The package extends funding for the federal government through Jan. 30 and includes full-year funding for the Agriculture Department, military construction and the legislative branch. The bill also includes language guaranteeing the reversal of federal layoffs initiated by the Trump administration during the shutdown in a move to pressure Democrats, as well as a moratorium on future cuts.

The federal government is back open. Now what? - Jake Sherman, John Bresnahan and Laura Weiss, Punchbowl News. "This shutdown was about one thing: expiring Obamacare tax credits and what that means for millions of ACA enrollees nationwide."

Shutdown Deal Punts Fate of ACA Tax Credit to December - Katie Lobosco and Cady Stanton, Tax Notes ($):

...

But there’s no guarantee that Republicans will vote in favor of an extension of the ACA credit, and even if a bill passes the Senate, House Speaker Mike Johnson, R-La., hasn’t committed to scheduling a vote in the House.

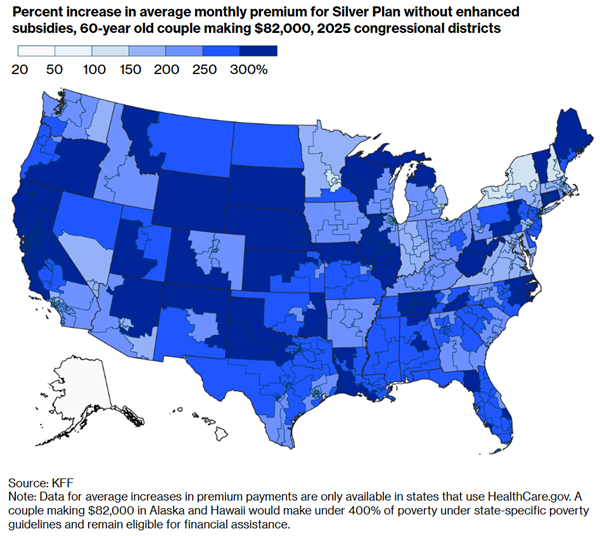

The enhanced tax credit, a temporary boost to the original ACA subsidy, was passed by Democrats during the COVID-19 pandemic. It makes more middle-income taxpayers who buy healthcare insurance through ACA exchanges eligible for a subsidy and makes insurance more affordable for some lower-income enrollees.

The Next Shutdown?

The next shutdown threat is around the corner - Jennifer Scholtes, Katherine Tully-McManus and Jordain Carney, Politico:

The bipartisan deal to end the funding lapse includes a long-term agreement on just three of the dozen bills lawmakers need to finish each year to keep cash flowing to federal programs. And those three measures are some of the easiest to rally around — including money for veterans programs, food aid, assistance for farmers and the operations of Congress itself.

GOP’s Shutdown Win May Backfire Over Soaring Health-Care Costs - Steven Dennis, Bloomberg:

But with millions of Americans now facing a spike in health care premium costs at the start of next year, the issue could quickly become a drag on Republicans in the 2026 midterm elections.

IRS and Shutdown's End

What’s Next for the IRS After the End of the Shutdown, Explained - Erin Slowey, Bloomberg ($):

...

Employees critical to filing season were largely exempt from furlough and continued working. In practice though, the furloughing of everyone else still complicated work for those who stayed on. The agency warned that phone assistance, refund payments, and appointments with appeals would be hampered during the shutdown.

Workers following the shutdown will be managing a backlog of paper processing and tax refund payments, and will likely face a barrage of phone calls from people who couldn’t reach the IRS during the funding lapse.

Tariffs and Dividends

Ports Warn USTR Against China Ship Fees, Crane Tariffs - Dylan Moroses, Law360 Tax Authority ($):

The American Association of Port Authorities submitted comments Monday recommending that the USTR work to eliminate the Chinese and foreign vessel fees, along with the tariffs on ship-to-shore, or STS, cranes, during the one-year suspension agreed to as part of the deal between the U.S. and China. The measures were implemented as part of a Section 301 investigation into the unfair trading practices of the Chinese maritime, logistics and shipbuilding sectors.

Bessent says tariff cuts on coffee, other ag products coming soon - Doug Palmer, Politico:

“You’re going to see some substantial announcement over the next couple of days in terms of things we don’t grow here in the United States, coffee being one of them,” Bessent aid in an interview on Fox News. “Bananas, other fruits, things like that. So that will bring the prices down very quickly.”

So tariffs raise prices. Who knew?

Trump can’t quit his favorite economic idea - Semafor:

Trump tariff rebate checks could cost twice as much as their revenue: Analysis - Sylvan Lane, The Hill:

U.S. tariffs are only projected to generate $300 billion in federal revenue by the end of the year and are responsible for just $100 billion in federal funds so far, according to the CRFB.

Taxes Around The World: Compliance Costs, British Tax Boosts

Tax News & Views International Weekly: Pillar Two's Escalating Compliance Costs - Alex Parker, Eide Bailly:

There have been few solid figures yet in the discussion—just a lot of anecdotal evidence. But Tax Foundation Europe, the Brussels-based branch of the conservative-leaning U.S. think tank, may have finally shed some light on the potential scale of the issue. The Foundation, along with the German economic research organization ZEW, recently issued a discussion paper which estimated that the compliance cost could reach into the billions.

Related: Eide Bailly International Tax Services.

Britain Is Preparing Tens of Billions in New Taxes—Again - David Luhnow, Wall Street Journal:

Taken together, the two rounds of tax increases will be Britain’s biggest since the mid-1970s, according to estimates by Capital Economics. The increases will likely further constrain Britain’s anemic economic growth.

Blogs and Bits

Will You Pay More Taxes If You Are Paid In December Or January? - Robert Wood, Forbes. "In general, you can do this kind of tax deferral planning as long as you negotiate for it up front and have not yet performed the work."

Forms W-8BEN and W-9: Which to Use, When, and Why Many Get It Wrong - Virgina La Torre Jeker, US Tax Talk. "It is crucial to understand the differences between Form W-8BEN and Form W-9 when receiving payments from U.S. sources. This is especially so if the taxpayer operates, invests, or maintains financial accounts overseas. Many taxpayers get this wrong, often to their detriment."

Tax Court’s Third Strike On Valuation: Jones Day Theory Rejected Again - Peter Reilly, Forbes:

Tilting the Playing Field: Tax Preferences for Cooperatives and Government-Owned Enterprises- Jack Salmon, The Unseen and the Unsaid. "Cooperatives, state and local government enterprises, and federally owned corporations together generate over $1.4 trillion in commercial revenue each year. Yet much of that activity escapes entity-level taxation entirely. The result is a sprawling untaxed sector that competes directly with private firms on an uneven playing field..."

Quotable

- Jack Townsend, Federal Tax Procedure, discussing a case in which a doctor's tax plans went expensively awry.

IRS vs. Acting IRS Commissioner in Partnership Tax Issue

The I.R.S. Tried to Stop This Tax Dodge. Scott Bessent Used It Anyway. - Andrew Duehren, New York Times:

Like many firms on Wall Street, Mr. Bessent’s hedge fund, Key Square Capital Management, was set up as a limited partnership. Through that structure, Mr. Bessent avoided paying roughly $910,000 in Medicare taxes on money he made running his hedge fund in 2021, 2022 and 2023, according to a memorandum prepared by Democratic Senate staff for Mr. Bessent’s confirmation hearing in January.

The issue, simplified, is whether being a "limited" partner under state law makes you a limited partner under tax law rules, eligible for the "limited partner exception" from self-employment tax. For high-income taxpayers, that's the 3.8% Medicare component of self-employment tax. The IRS has argued that tax regulations look at what the partner's actual role is with the partnership controls, not the state-law label.

From the article:

The article discusses two important Tax Court decisions that upheld the IRS position, both involving Soroban Capital Partners:

“A partner labeled a limited partner who works for the business full time, whose work is essential to generating the business’s income, who is held out to the public as essential to the business, and who contributes little or no capital, is not functioning as a limited partner regardless of the label placed on that partner,” Judge Buch wrote in a ruling this year.

The article discusses the uncertainty surrounding the IRS position on this issue now, and the agency's diminished ability to enforce its position with a diminished workforce. It is an unusually detailed and informative discussion of an issue not normally covered outside the tax world.

Related: Eide Bailly Passthrough Entity Consulting Services.

What day is it?

It's National Hug a Musician Day! It's also Symphonic Metal Day, so wear hearing protection.

Make a habit of sustained success.