Key Takeaways

- Bill to end shutdown goes to House.

- No ACA expanded credit extension.

- What's next, possible obstacles in House.

- How IRS is affected.

- Trusts get crypto staking safe harbor.

- More on tariff "dividend."

- Corporate AMT nibbles at Trump tax cuts.

- Veterans Day.

Senate passes bill to reopen government; House set to return to DC - Alexander Bolton, The Hill. "The Senate voted 60-40 to pass a bill to fund military construction, veterans’ affairs, the Department of Agriculture and the legislative branch through Sept. 30, 2026, and the rest of government through Jan. 30."

An emerging shutdown deal doesn’t extend expiring health subsidies. Here’s what could happen to them - Ali Swenson, Associated Press:

The deal agreed to by Senate Republicans and a handful of Democrats on Sunday instead only guarantees a December vote on the enhanced premium tax credits, which are set to expire at the end of the year without congressional action.

Even then, House Speaker Mike Johnson, R-La, hasn’t agreed to a matching House vote on the issue, making the chances of an extension increasingly bleak.

Democrats want to extend Obamacare credits. Republicans have other ideas. Benjamin Guggenheim and Meredith Lee Hill, Politico:

The gathering came after Cassidy and Scott called on Republicans to ditch the Obamacare tax credits altogether and fund tax-advantaged health savings accounts for individuals to pay directly for care.

Sen. Thom Tillis, a retiring Finance Committee Republican, said in an interview Monday that it would probably be smart to extend current policy for a year because of the encroaching deadline and then implement changes the following year.

What’s next for the CR in the House - Jake Sherman, Laura Weiss and Ally Mutnick, Punchbowl News:

Yet Johnson has only a two-vote margin and will need all the help he can get. House Republican leadership is watching GOP Reps. Marjorie Taylor Greene (Ga.), Thomas Massie (Ky.), Victoria Spartz (Ind.) and Warren Davidson (Ohio) as possible no votes. Massie is almost guaranteed to vote no.

House Democratic leadership — led by Minority Leader Hakeem Jeffries —is whipping against the bill because it doesn’t address the expiring Obamacare premium tax credits.

Shutdown Shutdown and the IRS

Senate Advances Shutdown Deal, Leaves ACA Tax Credit in Limbo - Cady Stanton, Tax Notes ($):

When asked whether the White House would abide by the agreement to rehire federal employees affected by the RIFs, President Trump told reporters he’d “abide by the deal, the deal is very good."

The deal would also include guaranteed back pay for all federal workers affected by the shutdown, according to [House Speaker Mike] Johnson. The Office of Management and Budget had circulated a memo in October casting doubt on whether the government is explicitly obligated to provide back pay to furloughed workers during the shutdown under the 2019 Government Employee Fair Treatment Act, as opposed to essential workers.

How IRS Workers Can Get Relief from the Shutdown Deal, Explained - Erin Slowey, Bloomberg ($):

Roughly 1,300 IRS workers, who typically do back office work like training, scheduling and communications, were fired as part of a broader government-wide layoff during the shutdown, though a federal judge blocked the government from proceeding with the layoffs. Employees in exam and collections made up almost 40% of those workers.

Trusts Get Crypto Staking Safe Harbor

IRS Guidance Enables Trusts to Stake Digital Assets - Kristen Parillo, Tax Notes ($):

...

Under the tax code and Treasury regulations, a legal-form trust will be classified as an investment trust — rather than as a business entity — only if it isn’t engaged in a profit-making business, doesn’t have the power to vary its investment portfolio, and has only one class of ownership interests. Investors in an investment trust that is a grantor trust are treated as if they were the direct owners of their pro rata interests in trust assets for federal income tax purposes and receive tax reporting from the trust or their brokers on Forms 1099.

Stakeholders have requested guidance addressing whether a trust holding digital assets that stakes those assets and receives staking rewards can qualify as an investment trust treated as a grantor trust, the report said.

Tariff Tuesday: Rebates, Switzerland, Port Fee Pivot

Trump’s $2,000 Tariff ‘Dividend’ Marks Throwback to Covid Checks - Daniel Flatley, Bloomberg via MSN:

...

Back in December 2020, Trump was pressing US lawmakers to amp up pandemic-aid checks to $2,000 from the $600 that they went on to approve. His successor Joe Biden made up the $1,400 gap in his American Rescue Plan in March 2021.

Some economists now blame excess federal payouts for contributing to the 2021-22 inflation surge — the worst since the early 1980s. More than four years on, consumer-price increases still haven’t returned to pre-Covid levels, raising the risk that a fresh wave of cash-drops into US households stokes inflation again.

Treasury secretary on Trump $2K tariff dividend vow: ‘It could just be … tax decreases’ - Sarah Fortinsky, The Hill:

“I haven’t spoken to the president about this yet, but … the $2,000 dividend could come in lots of forms, in lots of ways, George,” Bessent said.

“It could be just the tax decreases that we are seeing on the president’s agenda,” he continued. “You know, no tax on tips, no tax on overtime, no tax on Social Security. Deductibility of auto loans.”

Don’t Spend Trump’s $2,000 A Person Tariff Dividend Check Just Yet - Kelly Phillips Erb, Forbes. "While the President may be able to impose some tariffs, only Congress has the authority to spend federal money. That includes sending checks to the public."

Switzerland nears deal to cut US tariffs to 15% after business push - Mercedes Ruehl and Aime Williams, Financial Times:

After months of frustration and stalled diplomacy Swiss business leaders stepped in to drive the talks forward, moving from lobbying on the sidelines to engaging directly with the Trump administration. Companies said they were starting to feel the strain of the 39 per cent tariffs imposed on most Swiss goods in August — the highest levies faced by any developed economy.

Dems, union groups blast Trump’s port fee pivot - Ari Hawkins, Politico. "Democrats in Congress, joined by labor unions, are condemning the Trump administration’s decision to delay port fees tied to an investigation into China’s shipbuilding practices, a move that took effect today."

Corporate AMT Nibbles at Trump Tax Cuts

CAMT and R&D, the latest - Bernie Becker, Politico:

The biggest culprit there, from companies’ perspective, is the accelerated deductions that Republicans put in the megabill as part of bringing back full, immediate write-offs for domestic research.

Capitol Hill Recap: The CAMT Clash - Alex Parker, Eide Bailly:

Blogs and Bits

Changes to Charitable Giving Under the One Big Beautiful Bill Act - Emily Kraschel and Erica York, Tax Policy Blog. "First, it imposes a new floor on the deduction for charitable contributions. Starting in 2026, charitable donations below 0.5 percent of adjusted gross income (AGI) will not be deductible."

Ranching Activity Was Not Operated for Profit; Losses Disallowed - Parker Tax Pro Library. "The Tax Court held that a couple's ranching activity was not an activity engaged in for profit and thus the couple could not deduct the losses claimed on their tax returns for the years at issue. Applying the nonexclusive list of factors in Reg. Sec. 1.183-1, the court found that the taxpayers did not have a profit motive, given the absence of a business plan, the occasional small profit from an activity that generated large losses, and the personal pleasure the taxpayers derived from the activity."

Affluent Aid - Jack Salmon, The Unseen and the Unsaid. "If lawmakers are serious about fiscal responsibility, they should let the enhanced subsidies expire as scheduled and focus on reforming the ACA to make premiums more competitive and transparent, not endlessly layering subsidies that enrich insurers at taxpayers’ expense."

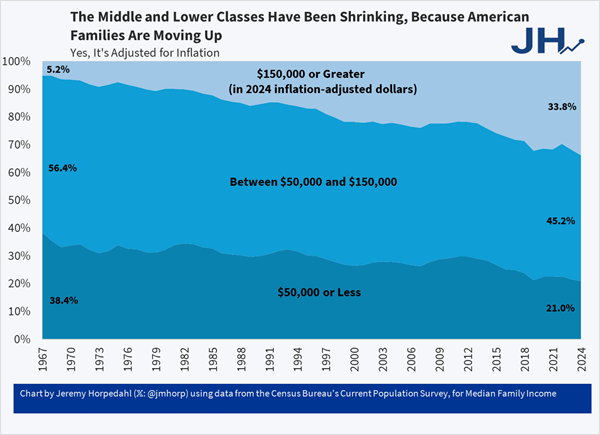

One-Third of US Families Earn Over $150,000 - Alex Tabarrok, Marginal Revolution. "It’s astonishing that the richest country in world history could convince itself that it was plundered by immigrants and trade. Truly astonishing."

What day is it?

It's Veterans Day. "To care for him who shall have borne the battle and for his widow, and his orphan" - Lincoln's Second Inaugural.

Make a habit of sustained success.